2025-11-27

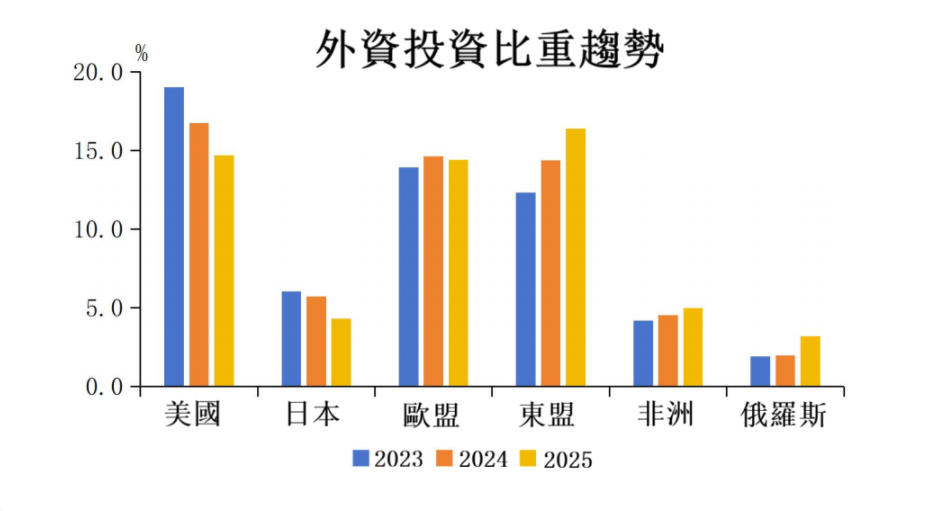

Against the backdrop of a continued restructuring of global capital flows, Southeast Asia is becoming a focal point for international investors. According to the latest data from the United Nations Conference on Trade and Development (UNCTAD) and the ASEAN Secretariat, total foreign direct investment (FDI) flowing into ASEAN reached US$225 billion in 2024, representing a year-on-year increase of approximately 10%, significantly higher than the global average. In this context, Hong Kong-based investment firm Chenguang Capital recently announced the launch of an "Academy Membership" program to further enhance its research depth and strategic synergy capabilities in the regional market.

In recent years, ASEAN economies have demonstrated strong resilience. If considered as a single economy, their GDP has surpassed US$4.13 trillion, firmly ranking fifth globally. Driven by manufacturing relocation, the rise of the digital economy, and accelerated regional integration, Malaysia and Singapore are increasingly becoming key nodes for foreign investment. Singapore, with its mature financial infrastructure and stable policy environment, continues to solidify its position as an Asia-Pacific hub; Malaysia, with its cost advantages and industrial upgrading potential, attracts substantial investment in technology and manufacturing. The Johor-Singapore Economic Zone (JS-SEZ), jointly promoted by the two countries, is seen as an important vehicle for future regional capital flows and supply chain integration.

As an investment institution focused on the Asian market, Morninglight Capital has consistently regarded ASEAN as a core allocation region since its establishment in 2021. The company has an office in Shanghai and is preparing to establish new locations in Singapore and Kuala Lumpur to achieve deep coverage of the local markets. Its investment methodology emphasizes combining economic theory, behavioral finance insights, and data technology, aiming to identify long-term value from structural changes.

Over the past two years, Morninglight Capital's various strategy portfolios focusing on the Asian region have demonstrated strong adaptability in a complex market environment. For example, the "Aurora Strategy," launched in 2024, focused on the energy transition and consumption recovery, achieving outstanding performance in its initial phase. The "Dawn Strategy," launched in the first half of 2025, focused on the new energy and technology sectors, making good progress against the backdrop of regional innovation momentum. The currently operating "Sunrise Strategy" aims to capture cross-market opportunities amidst market volatility through a multi-asset linked trading mechanism. These practices have provided an empirical basis for subsequent strategy iterations.

To enhance the foresight and practicality of its strategy development, Morninglight Capital recently launched an "Academy Membership" mechanism. This mechanism is not a traditional product sales channel, but rather a collaborative investment research platform for professional investors and institutional partners. Through regular closed-door seminars, regional field research, and strategy retrospective analysis, members can discuss market evolution logic and optimize asset allocation frameworks with the Morninglight team.

“In an environment of rising global uncertainty, single-point judgments are prone to failure, making systemic understanding more crucial,” said a representative from Morninglight Capital. “The ‘Academy Membership’ is a new type of collaborative relationship we are trying to build—not a one-way output of viewpoints, but an enhancement of understanding of complex markets through the collision of diverse perspectives.”

Industry observers point out that with foreign capital rapidly flowing into Southeast Asia, localized insights and cross-market collaboration capabilities will become core competencies for investment institutions. Morninglight Capital’s “Academy Membership” mechanism strengthens its investment research loop, potentially paving a differentiated path for it in the highly competitive Asian asset management market.

Currently, the mechanism is in the initial member invitation phase, primarily targeting institutional investors and high-net-worth individuals with some international market experience. Morninglight Capital emphasizes that all strategy discussions are based on compliance, and past performance does not predict future results, nor does it constitute any investment advice or return guarantee.

Disclaimer: This article is reproduced from other media. The purpose of reprinting is to convey more information. It does not mean that this website agrees with its views and is responsible for its authenticity, and does not bear any legal responsibility. All resources on this site are collected on the Internet. The purpose of sharing is for everyone's learning and reference only. If there is copyright or intellectual property infringement, please leave us a message.

©copyright 2009-2020 Zao Bao Daily Contact Us SiteMap